Introduction

Digital currency is money in electronic form.

It is not paper money. It is not coins.

We cannot touch it. We cannot hold it in our hands.

It lives inside mobile phones, computers, and bank systems.

Today, many people use digital money instead of cash.

When we send money using mobile apps, that is digital currency.

What is Digital Currency?

Digital currency means money that moves through the internet.

You can send it, receive it, save it, and use it for payments.

Examples:

- UPI payments

- Mobile banking

- Online shopping payments

- QR code payments

- Digital wallets

It works using bank accounts and mobile numbers.

Why People Use Digital Currency

People like digital payments because:

- It is fast

- It is easy

- No need to carry cash

- Less risk of losing money

- Works anytime (24/7)

- Safe with PIN and OTP

During the pandemic, digital payments increased a lot because people avoided physical cash.

You only need:

- A bank account

- A mobile number

- Internet connection

Then you can send or receive money anytime.

Digital Currency Scenario – Other Countries

| Country | Digital Currency Status | Type | Current Stage | Notes |

|---|---|---|---|---|

| China | Digital Yuan (e-CNY) | Retail CBDC | Large Pilot | Used in many cities |

| USA | Research Phase | Possible CBDC | Under Study | No official launch yet |

| India | Digital Rupee | Retail & Wholesale CBDC | Pilot Stage | Tested by banks |

| Sweden | e-Krona | Retail CBDC | Testing | Reducing cash usage |

| Bahamas | Sand Dollar | Retail CBDC | Fully Launched | First country to launch CBDC |

| Nigeria | e-Naira | Retail CBDC | Launched | Public adoption ongoing |

| European Union | Digital Euro | Retail CBDC | Research & Preparation | Not yet launched |

| Japan | Digital Yen | Retail CBDC | Testing | Pilot programs running |

Where Is Digital Currency Accessible?

You can access digital currency through:

-

Mobile banking apps

-

UPI apps

-

Internet banking

-

Digital wallets

-

Cryptocurrency exchanges

Mobile Banking Apps

Example:

-

Chase Bank Mobile App

-

Bank of America App

What you would see in the image:

A smartphone screen showing account balance, “Send Money,” “Pay Bills,” and transaction history.

UPI Apps

Example (India):

-

Google Pay

-

PhonePe

-

Paytm

What you would see in the image:

QR code scanner, “Send,” “Request,” bank account linked, and recent payments.

Internet Banking

Example:

-

HSBC Online Banking

-

Wells Fargo Online Portal

What you would see in the image:

A laptop screen showing dashboard with account summary, transfer options, and payment services.

Digital Wallets

Example:

-

PayPal

-

Apple Pay

-

Samsung Pay

What you would see in the image:

Phone tapping at POS machine, wallet balance screen, saved cards.

Cryptocurrency Exchanges

Example:

-

Binance

-

Coinbase

-

Kraken

What you would see in the image:

You only need:

-

A bank account

-

A mobile number

-

Internet connection

Then you can send or receive money anytime.

How To Use Digital Currency (Step-by-Step)

Step 1: Open a Bank Account

You need:

-

Bank account

-

Mobile number linked to bank

-

ATM/Debit card

Step 2: Install a Payment App

You can install:

-

UPI app

-

Mobile banking app

-

Digital wallet

Popular examples:

-

Google Pay

-

Paytm

Download only from official Play Store or App Store.

Step 3: Register and Verify

-

Enter mobile number

-

Verify using OTP

-

Create UPI PIN or password

Now your digital money is ready to use.

How To Send Money

You can send money by:

UPI ID

Enter receiver’s UPI ID → Enter amount → Enter PIN → Done

QR Code

Scan QR code → Enter amount → Enter PIN

Bank Account Number

Add account details → Transfer money

Where Can You Use Digital Currency?

| Use Area | Example | How It Works | Easy or Not? |

|---|---|---|---|

| Grocery Shops | Supermarket, Kirana store | Scan QR code and pay from wallet/app | Very Easy |

| Online Shopping | Amazon, Flipkart | Select digital payment at checkout | Easy |

| Electricity Bill | State electricity board website/app | Enter bill number and pay | Easy |

| Mobile Recharge | Jio, Airtel apps | Enter mobile number and pay | Very Easy |

| Ticket Booking | Train, Bus, Movie tickets | Pay online while booking | Easy |

| Sending Money | Friends & Family | Enter phone number or UPI ID | Very Easy |

How To Stay Safe While Using Digital Currency

-

Never share OTP

OTP (One Time Password) is secret.

No bank or app will ask for it.

If you share OTP, money can be stolen. -

Never share PIN

Your PIN is like your ATM password.

Keep it private.

Do not tell anyone — even friends. -

Use strong password

Make password with:-

Capital letters

-

Small letters

-

Numbers

-

Special symbols (@, #, $)

Example:

Peter@2026#

Do not use simple password like 1234. -

-

Do not click fake links

Fraud messages look real.

Do not click unknown links from SMS, WhatsApp, or email.

Always use official bank app. -

Check app before download

Download only from Play Store or App Store.

Check reviews and developer name. -

Log out on shared phones

If you use someone else’s phone, log out after payment.

Digital Currency – Problems and Details

| No | Issue | Why It Happens | Who Is Affected | Example Situation | Result |

|---|---|---|---|---|---|

| 1 | Internet Problem | No network or slow internet | Rural users, travelers | Payment stuck in weak signal area | Transaction fails |

| 2 | Cyber Fraud | Fake links, OTP scams | New users, elderly people | Clicking fake bank SMS link | Money loss |

| 3 | Technical Error | Server down or app bug | All users | App shows “Payment Pending” | Delay or confusion |

| 4 | Privacy Issue | Transactions are recorded | Privacy-concerned users | Government tracks payment history | Less privacy |

| 5 | Lack of Knowledge | Low digital skills | Elderly, first-time users | Entering wrong PIN | Fear or mistakes |

| 6 | Device Problem | Phone battery dead or damaged | Smartphone users | Phone switched off at shop | Cannot pay |

| 7 | Security Risk | Weak password or unlocked phone | Careless users | Phone stolen without lock | Account misuse |

| 8 | Hidden Charges | Platform fees | Traders, investors | Small trading fees added | Reduced profit |

| 9 | Legal Rules | Changing government policies | Crypto users | Ban or tax update | Uncertainty |

| 10 | Price Volatility | Market price changes fast | Investors | Crypto price drops suddenly | Financial loss |

above i expanled full deatail of what is currenc now here below more about what we

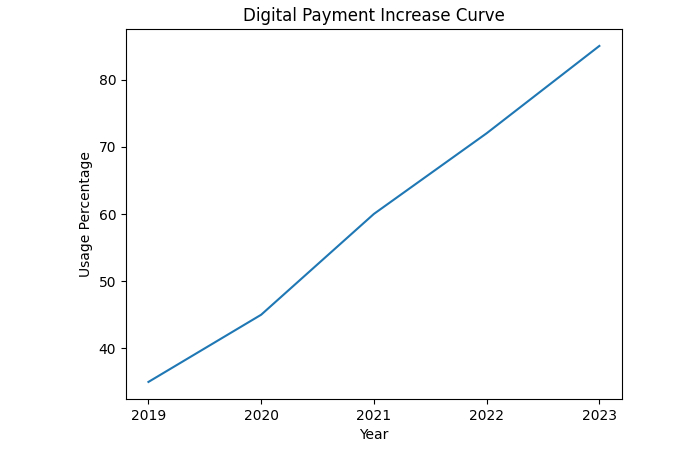

Growth of Digital Payments

| Year | Usage Percentage | Growth From Previous Year |

|---|---|---|

| 2019 | 35% | — |

| 2020 | 45% | +10% |

| 2021 | 60% | +15% |

| 2022 | 72% | +12% |

| 2023 | 85% | +13% |

The graph shows that digital payments are growing every year.

From 2019 to 2023, the usage percentage increased steadily.

-

In 2019, digital payment usage was around 35%.

-

In 2020, it increased to 45%.

-

In 2021, it reached 60%.

-

In 2022, it grew to 72%.

-

In 2023, it touched 85%.

The curve is moving upward.

This means more people are using digital payments every year.

The biggest growth happened between 2020 and 2021.

This increase happened mainly because of:

-

COVID-19 pandemic

-

Growth of UPI apps

-

More smartphone users

-

Government support for digital payments

Overall, the trend shows strong and continuous growth.

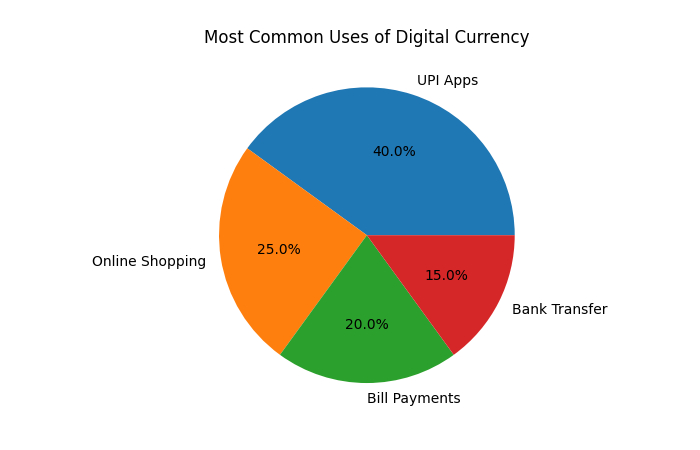

Most Common Uses of Digital Currency

| Use Type | Percentage | Meaning |

|---|---|---|

| UPI Apps | 40% | Most common payment method |

| Online Shopping | 25% | Buying products online |

| Bill Payments | 20% | Paying utility bills |

| Bank Transfer | 15% | Direct account transfer |

The pie chart shows how people mostly use digital currency.

Each section of the circle shows a different purpose and its percentage.

Breakdown of Usage

-

UPI Apps – 40%

This is the largest part.

Most people use digital currency through UPI apps for quick payments. -

Online Shopping – 25%

Many people use digital payments to buy products from online websites. -

Bill Payments – 20%

People use digital currency to pay electricity, water, gas, and internet bills. -

Bank Transfer – 15%

Some users transfer money directly from one bank account to another.

Retail Digital Currency (Public Accessible)

Retail digital currency means digital money that common people (general public) can use for daily payments like shopping, bill payment, or transfers.

Here is a simple comparison table:

| Feature | Central Bank Digital Currency (CBDC) | Cryptocurrency | Mobile Wallet / UPI |

|---|---|---|---|

| Issued By | Central Bank (Government) | Private / Decentralized Network | Private Companies / Banks |

| Example | Digital Rupee | Bitcoin | Google Pay |

| Who Can Use | General Public | Anyone with internet | Bank Account Holders |

| Regulation | Fully Government Regulated | Not fully regulated in many countries | Regulated by Central Bank |

| Value Stability | Stable (same as national currency) | Highly Volatile | Same as bank balance |

| Risk Level | Low | High | Low |

| Main Use | Daily retail payments | Investment / trading | Daily payments & transfers |

Digital Currency vs Physical Currency

| Feature | Digital Currency | Physical Currency |

|---|---|---|

| Form | Electronic | Paper & coins |

| Speed | Instant | Slow/manual |

| Security | Encrypted | Can be stolen |

| Global use | Easy | Limited |

| Tracking | Transparent | Hard to trace |

Future of Digital Currency Trends by 2030

| Trend | Expected Growth by 2030 |

|---|---|

| Countries exploring CBDCs | 130+ countries |

| Central banks working on CBDCs | 90% worldwide |

| CBDCs likely to be launched | 15–24 countries |

| Global crypto users | ~1 billion (projected) |

| Share of digital/cashless payments | Rapid global increase |

Source: Bank for International Settlements (BIS) CBDC surveys; International Monetary Fund reports; and global crypto adoption studies (Statista & industry research).

Conclusion

Digital currency is changing the way people use money. From small grocery shops to online shopping platforms, digital payments have become part of everyday life. The steady growth from 2019 to 2023 clearly shows that more people prefer fast, secure, and contactless transactions.

Retail digital currency, mobile banking, UPI apps, and digital wallets are making payments easier than ever. At the same time, users must stay careful about online fraud, OTP scams, and privacy risks.

Looking ahead to 2030, digital payments and CBDCs are expected to grow even more across the world. Governments, banks, and technology companies are investing heavily in secure digital financial systems.

Overall, digital currency is not just a trend — it is the future of global payments.