Introduction: Why Everyone Should Understand the Stock Market

Let me say this clearly.

If you only depend on salary, your money grows slowly.

If you save in a bank, your money grows a little.

But if you invest properly in the stock market, your money can grow faster than inflation.

Most people avoid the stock market because:

-

They think it is gambling

-

They think it is too complicated

-

They are afraid of losing money

But the real reason people lose money is not because of the market.

It is because they enter without knowledge.

This guide will explain everything in simple language.

By the end, you will understand:

-

What the stock market is

-

How it works

-

How to start

-

How to reduce risk

-

How to build long-term wealth

What Is the Stock Market?

The stock market is a place where ownership of companies is bought and sold.

When you buy a share, you become a small owner of that company.

Example:

If a company has 10 lakh shares and you buy 100 shares,

you own a small piece of that company.

If the company grows → your share price increases.

If the company struggles → price may fall.

That is the basic concept.

It is not gambling.

It is ownership.

Why Do Companies Sell Shares?

Companies need money to:

-

Expand business

-

Open new branches

-

Develop products

-

Pay debt

Instead of taking a big loan from bank, they raise money from the public.

This process is called IPO (Initial Public Offering).

After IPO, shares are traded daily in the stock exchange.

Stock Exchanges in India

In India, two major exchanges:

| Exchange | Established | Meaning |

|---|---|---|

| BSE | 1875 | Bombay Stock Exchange |

| NSE | 1992 | National Stock Exchange |

These exchanges are regulated by SEBI.

SEBI protects investors and ensures fair trading.

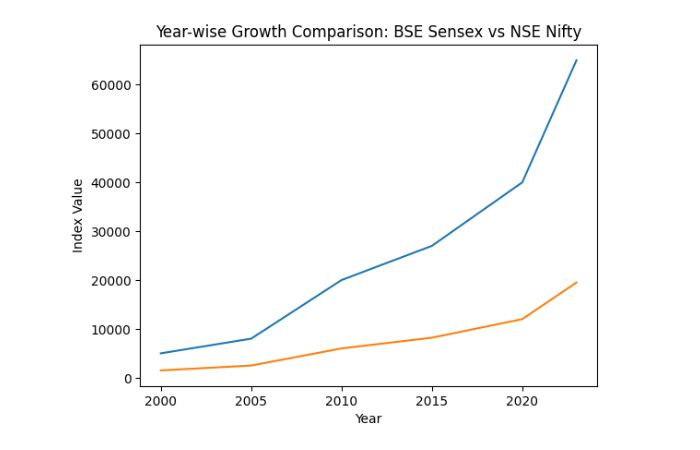

Stock Exchanges in India — Year-wise Comparison

You can also paste this directly in the article:

| Year | Sensex (Approx) | Nifty 50 (Approx) |

|---|---|---|

| 2000 | 5,000 | 1,400 |

| 2005 | 8,000 | 2,400 |

| 2010 | 17,500 | 5,250 |

| 2015 | 27,000 | 8,200 |

| 2020 | 40,000 | 11,700 |

| 2021 | 58,000 | 17,300 |

| 2022 | 61,000 | 18,100 |

| 2023 | 65,000 | 19,500 |

The growth curve clearly shows that both Sensex and Nifty have moved upward over the long term. Even though there were market crashes and corrections, the overall direction remains positive. This demonstrates why long-term investing in the Indian stock market has historically been rewarding.

How Stock Prices Move

Stock prices move because of demand and supply.

If more people want to buy → price increases.

If more people want to sell → price decreases.

But what creates demand?

Main factors:

-

Company profit growth

-

News

-

Government policies

-

Interest rates

-

Global market conditions

-

Industry performance

Example:

If a company reports 30% profit growth, investors get excited.

More buying → price rises.

How Investors Make Money

There are 3 main ways:

1. Capital Gain

Buy at ₹100 → Sell at ₹150 → Profit ₹50

2. Dividend

Some companies share part of their profit.

Example:

If company gives ₹10 per share dividend and you hold 100 shares,

you earn ₹1,000.

3. Long-Term Compounding

Here is where real wealth is built.

If you invest ₹10,000 at 12% yearly return:

After 5 years → ₹17,600

After 10 years → ₹31,000

After 20 years → ₹96,000

After 25 years → ₹1,70,000+

Small growth in early years.

Massive growth later.

This is compounding.

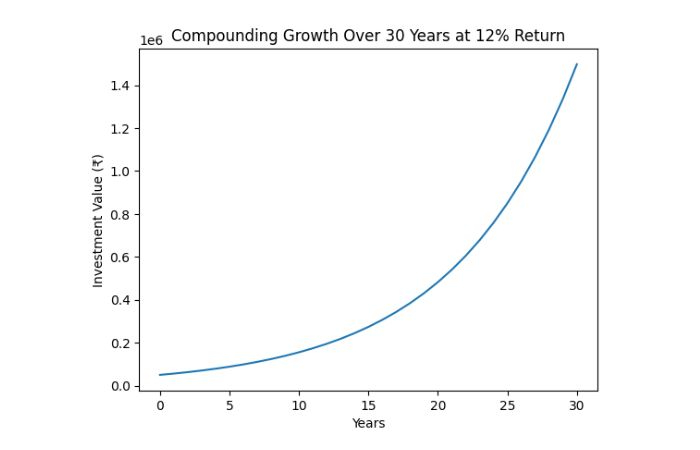

Power of Compounding

Compounding means earning returns on your returns.

If you invest ₹50,000 at 12% annual return:

After 10 years → around ₹1.55 lakh

After 20 years → around ₹4.8 lakh

After 30 years → around ₹15 lakh

Notice how growth is slow in early years but becomes very steep later. This is why starting early is powerful.

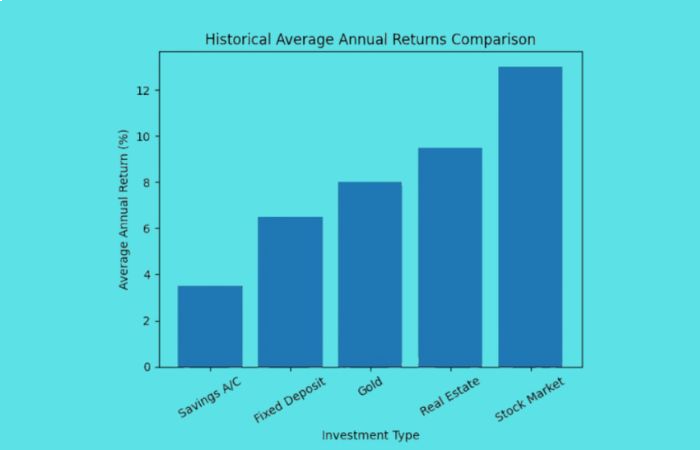

Historical Returns Comparison

Long-term average returns (India approximate):

| Investment Type | Average Annual Return |

|---|---|

| Savings Account | 3–4% |

| Fixed Deposit | 6–7% |

| Gold | 7–8% |

| Real Estate | 9–10% |

| Stock Market (NIFTY long-term) | 12–15% |

Stock market gives higher return over long term.

But remember:

Higher return = higher short-term volatility.

As you can see in the chart above, the stock market has historically given higher returns compared to traditional options. That small percentage difference becomes huge over time.

Types of Stocks

Large Cap

-

Big companies

-

Stable

-

Lower risk

Examples: Reliance, TCS

Mid Cap

-

Growing companies

-

Medium risk

Small Cap

-

Smaller companies

-

High growth potential

-

High risk

Beginners should start with large cap.

What Is Risk?

Risk does not mean permanent loss.

Risk means price fluctuation.

Short term: market may fall 10–30%

Long term: usually recovers and grows

Example:

During 2020 crash, market fell sharply.

Within 2 years, it recovered strongly.

Time reduces risk.

Investing vs Trading

| Investing | Trading |

|---|---|

| Long-term | Short-term |

| Based on company growth | Based on price movement |

| Lower stress | High stress |

| Wealth building | Quick income attempt |

Beginners should avoid day trading.

Focus on investing.

What You Need to Start

To invest in India, you need:

-

PAN card

-

Aadhaar

-

Bank account

-

Demat account

-

Trading account

You can open account through brokers like:

-

Zerodha

-

Groww

-

Upstox

-

Angel One

Process is online.

Important Stock Market Terms

Market Capitalization

Company total value.

Formula:

Share price × Total shares

EPS

Earnings Per Share.

P/E Ratio

Price divided by earnings.

High P/E → expensive

Low P/E → cheaper (but must check quality)

Dividend Yield

What Is an Index?

Index shows overall market performance.

In India:

-

NIFTY 50

-

SENSEX

If NIFTY goes up 1%, it means top companies on average increased.

Many beginners invest in index funds.

What Is Mutual Fund?

Mutual fund collects money from many investors.

Professional fund manager invests on your behalf.

Good for:

-

Busy people

-

Beginners

-

Low research investors

What Is SIP?

SIP = Systematic Investment Plan.

Instead of investing ₹1,20,000 at once,

invest ₹10,000 monthly.

Benefits:

-

Reduces risk

-

Average cost

-

Builds discipline

Power of Starting Early

Example:

Person A starts at age 25

Invests ₹5,000 monthly till 45

At 12% return → around ₹50+ lakh

Person B starts at 35

Invests same till 60

May still have less than Person A

Time matters more than amount.

Diversification Strategy

Never put all money in one stock.

Example beginner allocation:

| Category | Allocation |

|---|---|

| Large Cap Stocks | 40% |

| Index Fund | 30% |

| Mid Cap | 15% |

| Debt Fund | 15% |

This reduces overall risk.

Common Beginner Mistakes

-

Following WhatsApp tips

-

Buying because others buy

-

Panic selling

-

Checking portfolio daily

-

No long-term vision

Patience is the biggest skill.

Emotional Control

Market will test you.

-

Fear during crash

-

Greed during rally

Successful investors stay calm.

Bear Market vs Bull Market

Bull Market

Prices rising.

Bear Market

Prices falling.

Both are normal.

Market moves in cycles.

Realistic Expectations

Do not expect:

-

Double money in 6 months

-

Guaranteed profit

Realistic expectation:

10–15% average per year long term.

Should You Invest Now?

If you:

-

Have emergency fund

-

Have no high-interest debt

-

Can stay invested 5–10 years

Then yes, you can start.

Start small.

Sample Beginner Plan

Step 1: Open Demat account

Step 2: Invest in NIFTY index fund

Step 3: Add 2 strong large-cap stocks

Step 4: Do monthly SIP

Step 5: Review once a year

Simple strategy works.

Long-Term Wealth Mindset

Stock market rewards:

-

Discipline

-

Consistency

-

Time

Not:

-

Impatience

-

Greed

-

Fear

The stock market is not a shortcut to become rich quickly.

It is a system to grow wealth slowly and steadily.

If you:

-

Learn basic knowledge

-

Start early

-

Invest regularly

-

Stay patient

The stock market can help you build financial freedom.